Altair Capital

VC FundsInternational early-stage venture capital firm with $600M AUM, backing global tech unicorns including Miro, Deel, and Turing across AI, SaaS, and future of work sectors.

Altair Capital company profile

Overview

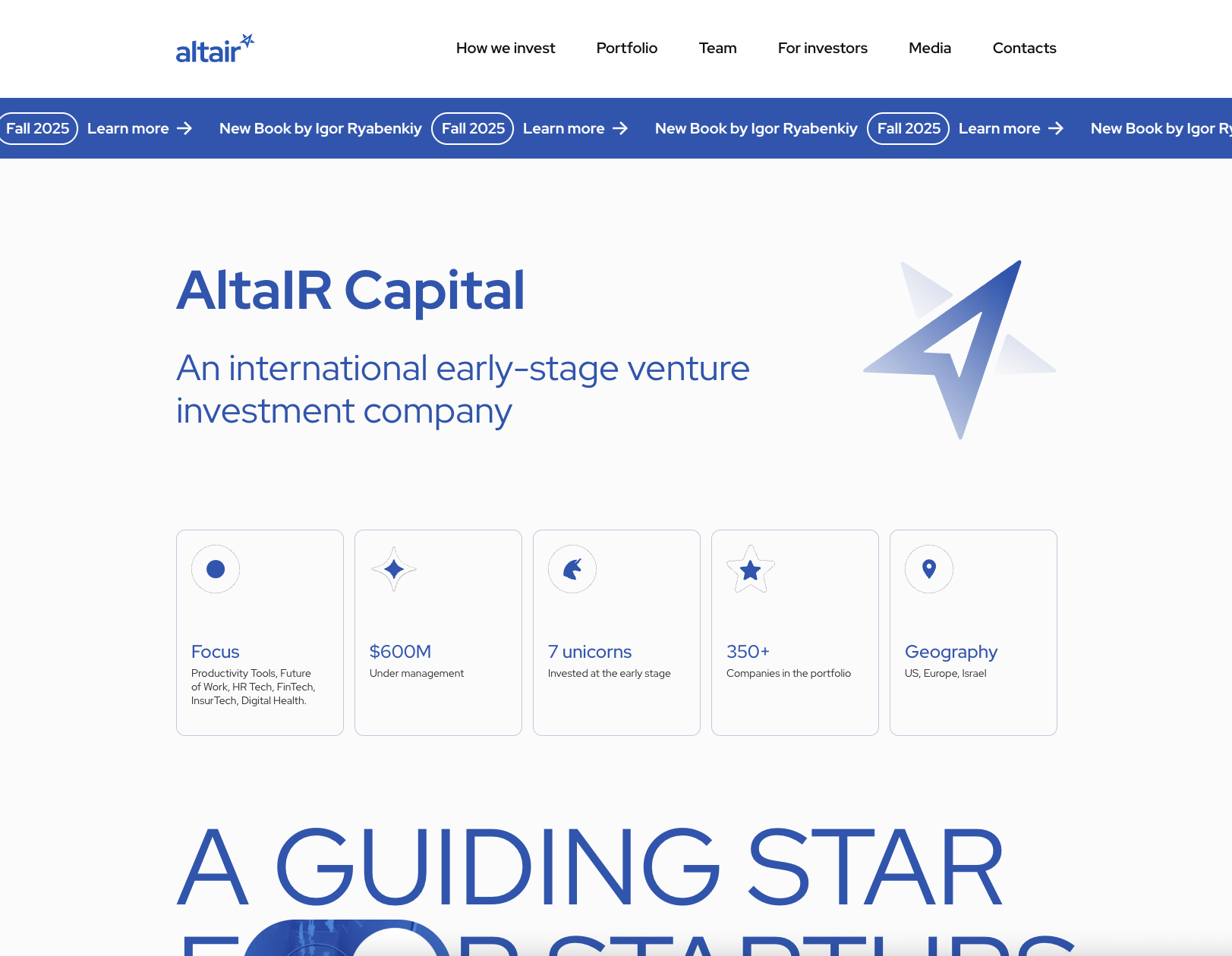

Altair Capital stands as one of the most successful early-stage venture capital firms in the global technology ecosystem, with a remarkable track record of identifying and nurturing companies that become industry leaders. Founded in 2005 by Igor Ryabenkiy, a serial entrepreneur who began angel investing in 1998, the firm has evolved from individual angel investments into a sophisticated institutional investor managing $600 million in assets across multiple funds.

The firm’s extraordinary success is reflected in its portfolio statistics: 350+ technology companies, 11 unicorns, and 2 decacorns (Miro and Deel), with 6 of these billion-dollar companies backed at the seed stage. This exceptional hit rate demonstrates Altair Capital’s ability to identify transformative technologies and exceptional founding teams before they achieve mainstream recognition. The firm’s first two funds have been fully paid back with returns exceeding 17x on invested capital, establishing Altair as a top-tier performer in venture capital.

Operating from New York with a global investment mandate, Altair Capital focuses on backing teams primarily from the United States, Israel, and Europe. The firm’s investment thesis centers on technologies that fundamentally change how people work and live, with particular emphasis on artificial intelligence, productivity tools, future of work solutions, and enterprise software. This focused approach, combined with deep operational expertise and a global network, has positioned Altair Capital as a preferred partner for ambitious entrepreneurs building category-defining companies.

Investment Philosophy

Altair Capital’s investment philosophy combines rigorous analytical frameworks with entrepreneurial intuition developed over decades of operational and investment experience:

| Investment Criteria | Focus Area | Sweet Spot | Value Addition |

|---|---|---|---|

| Stage | Pre-Seed to Series B | $500K - $10M initial investment | Lead or co-lead rounds |

| Geography | Global with US/Europe/Israel focus | Remote-first and distributed teams | Cross-border expansion support |

| Sectors | Enterprise SaaS and AI | B2B productivity and automation | Deep industry expertise |

| Team | Technical founders | Second-time entrepreneurs preferred | Operational mentorship |

| Market Size | Multi-billion dollar TAM | Growing 30%+ annually | Category creation potential |

| Business Model | Recurring revenue (SaaS) | High gross margins (70%+) | Scalable unit economics |

Early-Stage Focus with Growth Mindset

Altair Capital specializes in identifying companies at their inflection point, typically investing when startups have initial product-market fit signals but need capital and expertise to scale. The firm’s sweet spot is leading or co-leading seed and Series A rounds, providing not just capital but strategic guidance on product development, go-to-market strategy, and team building. This early engagement allows Altair to have maximum impact on portfolio companies’ trajectories while capturing the highest value creation periods.

Thesis-Driven Sector Expertise

The firm maintains deep expertise in specific sectors where technology creates exponential value: productivity tools that transform work processes, AI systems that augment human capabilities, fintech solutions that democratize financial services, and digital health platforms that improve healthcare access and outcomes. This focused approach enables Altair’s team to provide meaningful strategic value beyond capital, leveraging sector-specific knowledge, relationships, and pattern recognition from previous investments.

Founder-First Partnership Model

Recognizing that exceptional founders are the primary driver of venture returns, Altair Capital has developed a comprehensive founder support system. This includes access to the AltaClub network of successful entrepreneurs and operators, regular founder gatherings for peer learning, dedicated resources for recruiting and business development, and direct access to partners who have built and scaled companies themselves. The firm’s founder-friendly terms and collaborative approach have made it a preferred partner for serial entrepreneurs and first-time founders alike.

Portfolio Excellence

Altair Capital’s portfolio represents one of the highest concentrations of successful technology companies in the venture capital industry:

Decacorn Success Stories

Miro ($17.5B valuation): The collaborative whiteboard platform that Altair backed at seed has become the definitive solution for distributed team collaboration, used by 50 million users across 200,000 organizations. Altair’s early belief in visual collaboration tools and remote work trends positioned them perfectly for Miro’s explosive growth.

Deel ($12B valuation): Altair’s seed investment in Deel recognized the massive opportunity in global employment infrastructure before remote work became mainstream. The company now helps thousands of businesses hire and pay teams in 150+ countries, processing billions in payments annually.

Unicorn Portfolio Companies

The firm’s unicorn portfolio spans diverse sectors but shares common characteristics of technical excellence and market timing:

| Company | Sector | Investment Stage | Current Status |

|---|---|---|---|

| Turing | AI Talent Platform | Series A | Unicorn - AI development services |

| PandaDoc | Document Automation | Seed | Unicorn - Leading proposal software |

| OpenWeb | Community Platform | Series A | Unicorn - Publisher engagement |

| Socure | Identity Verification | Series B | Unicorn - AI fraud prevention |

| Sunbit | Point-of-Sale Financing | Series A | Unicorn - Buy-now-pay-later |

| Albert | Financial Automation | Series A | Unicorn - Personal finance AI |

Emerging AI Investments

Altair Capital has positioned itself at the forefront of the AI revolution, with recent investments in companies building foundational AI infrastructure, vertical AI applications, and AI-native business models. The firm’s partnership with companies like Turing demonstrates its ability to identify not just AI tools but the entire ecosystem needed to develop and deploy AI at scale.

Global Impact

Altair Capital’s influence extends far beyond financial returns, shaping the global technology ecosystem through strategic initiatives and partnerships:

Geographic Bridge Building

The firm’s unique position connecting Silicon Valley innovation with global talent pools has created extraordinary value. By backing teams from Israel’s deep tech ecosystem, European product excellence, and American go-to-market expertise, Altair facilitates cross-pollination of best practices and accelerates global expansion for portfolio companies. This international perspective has been particularly valuable in identifying arbitrage opportunities where superior technology from one region can dominate markets in another.

Ecosystem Development

Through the AltaClub angel network launched in 2015, Altair Capital has cultivated a community of over 100 successful entrepreneurs and operators who co-invest and mentor the next generation. The firm’s $50 million joint investment program with Yellow Rocks, Smart Partnership Capital, and I2BF, announced in 2024, further extends its ability to support early-stage entrepreneurs with both capital and expertise.

Knowledge Sharing and Thought Leadership

Managing Partner Igor Ryabenkiy’s book “Adventures in Venture Capital” and his Focus Point podcast have become essential resources for entrepreneurs and investors globally. The firm regularly hosts events bringing together founders, limited partners, and industry experts to discuss emerging trends, particularly in AI and future of work technologies. This commitment to knowledge sharing has established Altair as a thought leader in venture capital methodology and technology forecasting.

Economic Value Creation

With portfolio companies collectively employing tens of thousands of people and serving millions of customers globally, Altair Capital’s investments have created substantial economic value. The firm’s focus on productivity tools and enterprise software has particularly high leverage, as these companies enable their customers to operate more efficiently, ultimately impacting entire industries’ productivity and innovation capacity.

Future Vision

Altair Capital’s roadmap positions the firm to capitalize on the next wave of technological transformation while maintaining its disciplined investment approach:

AI-Native Investment Thesis

The firm is developing a comprehensive framework for investing in AI-native companies, recognizing that artificial intelligence will fundamentally restructure every industry. This includes backing companies building AI infrastructure layers, vertical AI applications that transform specific industries, AI-augmented productivity tools, and platforms that enable AI deployment at scale. Altair’s existing portfolio positions it perfectly to understand AI adoption patterns and identify the next generation of AI leaders.

Fund Evolution and Scale

With $600 million under management and proven returns, Altair Capital is positioned to raise larger funds while maintaining its early-stage focus. The firm plans to expand its investment team with specialists in emerging technologies, deepen its presence in key geographic markets, and develop dedicated programs for specific sectors like AI and climate technology.

Portfolio Value Creation

Altair is building institutional capabilities to support portfolio companies through their entire lifecycle, including dedicated recruiting and talent teams, business development and partnership networks, public market preparation and IPO readiness, and M&A advisory for strategic exits. This full-stack support model ensures portfolio companies can access resources typically available only to later-stage companies.

Next Decade Outlook

Looking ahead, Altair Capital is positioning itself for the convergence of multiple technological waves: artificial general intelligence and its implications, quantum computing commercialization, synthetic biology and computational medicine, and climate technology and sustainability solutions. The firm’s track record of identifying platform shifts before they become obvious, combined with its global network and operational expertise, positions Altair Capital to continue generating exceptional returns while backing companies that define the future of technology.

Altair Capital’s journey from angel investing to institutional venture capital excellence demonstrates the power of combining entrepreneurial experience with disciplined investment processes, global perspective with local expertise, and patient capital with active support.